When small business owners decide to offer retirement benefits to their employees, two of the most attractive options are the SIMPLE IRA and SIMPLE 401(k) plans. These plans, designed specifically for small businesses with 100 or fewer employees, provide a way for both the employer and employees to contribute toward retirement in a tax-advantaged manner. But which one is best for your business? Let’s dive into the similarities, differences, and key considerations to help you choose the right option.

What Is a SIMPLE IRA?

A Savings Incentive Match Plan for Employees (SIMPLE) IRA is a retirement savings plan that allows employees to contribute a portion of their salary on a pre-tax basis, with matching contributions made by the employer. SIMPLE IRAs are a great way for small businesses to offer a retirement plan without the administrative burdens and costs associated with traditional retirement plans like 401(k)s.

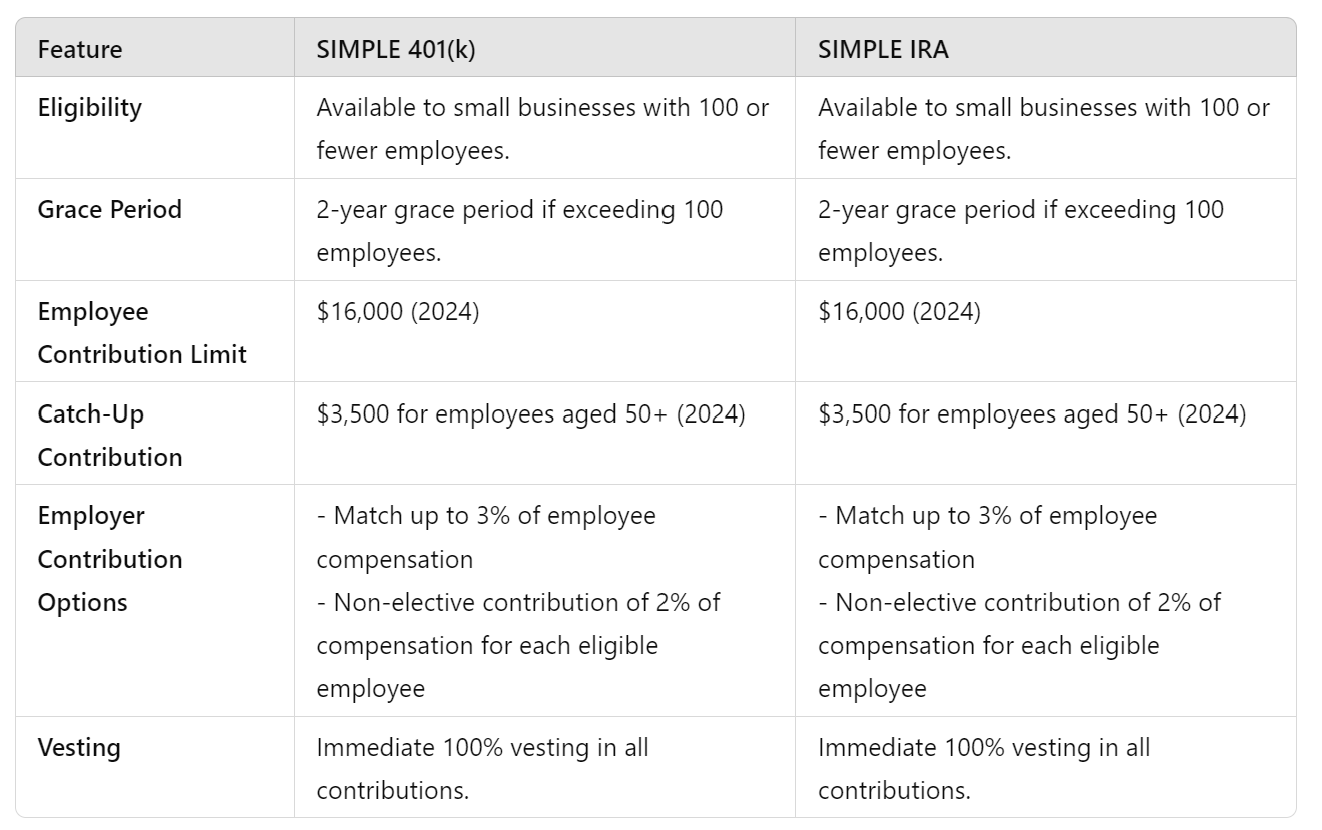

Key Features of a SIMPLE IRA:

Eligibility: Available to small businesses with 100 or fewer employees who earned at least $5,000 in compensation from the employer in the previous year.

Contribution Limits: Employees can contribute up to $16,000 in 2024. Employees aged 50 and older can make additional catch-up contributions of $3,500.

Employer Contributions: Employers can either match employee contributions up to 3% of their salary or make a non-elective contribution of 2% of each eligible employee’s salary, regardless of whether the employee contributes.

Vesting: Employees are 100% vested in their contributions and the employer’s contributions from day one.

Administrative Requirements: No annual filing requirements, making it easy and cost-effective to manage.

Withdrawal Penalties: Withdrawals before age 59½ are subject to a 10% penalty, increasing to 25% if the withdrawal occurs within the first two years of plan participation.

What Is a SIMPLE 401(k)?

A SIMPLE 401(k) plan is a cross between a traditional 401(k) and a SIMPLE IRA. Like a traditional 401(k), it allows for salary deferrals and has features such as participant loans. However, it shares some characteristics with the SIMPLE IRA, including the employee limit and simplified contribution rules.

Key Features of a SIMPLE 401(k):

Eligibility: Like the SIMPLE IRA, it’s designed for small businesses with 100 or fewer employees.

Contribution Limits: The contribution limit is $16,000 in 2024, with a $3,500 catch-up contribution for employees aged 50 and older.

Employer Contributions: Employers must make a 3% matching contribution or a 2% non-elective contribution for each eligible employee.

Vesting: All contributions are immediately 100% vested.

Administrative Requirements: Requires annual filing of Form 5500 with the IRS, which adds to the administrative workload.

Loan Options: Unlike a SIMPLE IRA, employees can take loans against their SIMPLE 401(k) balances.

Withdrawal Penalties: Similar to a traditional 401(k), early withdrawals (before age 59½) incur a 10% penalty unless the employee qualifies for an exception.

SIMPLE IRA vs. SIMPLE 401(k): The Key Differences

While both plans cater to small businesses, there are some distinct differences that may make one plan more attractive than the other based on your business needs.

Administrative Complexity

SIMPLE IRA: Easier to administer with no annual IRS filing requirements.

SIMPLE 401(k): Requires annual Form 5500 filing, adding some complexity and cost.

Flexibility for Loans

SIMPLE IRA: Does not allow for loans, which can be a disadvantage if employees want access to their funds.

SIMPLE 401(k): Loans are allowed, giving employees more flexibility in managing their finances.

Contribution Flexibility for Employers

SIMPLE IRA: Employers have the flexibility to reduce matching contributions to as low as 1% in two out of five years.

SIMPLE 401(k): Employers must stick to a 3% match or a 2% non-elective contribution, with no flexibility to reduce the match.

Additional Retirement Plans

SIMPLE IRA: If a business offers a SIMPLE IRA, it cannot offer any other retirement plan to employees.

SIMPLE 401(k): A business can offer a separate retirement plan to employees who are not eligible for the SIMPLE 401(k), providing more options.

Which One Should You Choose?

The decision between a SIMPLE IRA and a SIMPLE 401(k) often comes down to two main factors: administrative burden and plan flexibility.

Choose a SIMPLE IRA if: You want a low-cost, easy-to-administer plan with minimal paperwork. The SIMPLE IRA is ideal for small businesses that want to offer a retirement plan without getting bogged down in compliance requirements.

Choose a SIMPLE 401(k) if: You want more flexibility, such as allowing employees to take loans or offering a second retirement plan for specific groups of employees. The SIMPLE 401(k) is also a good choice if you’re looking for a plan that resembles a traditional 401(k) but without the complex non-discrimination testing.

Bottom Line

Both the SIMPLE IRA and SIMPLE 401(k) provide great options for small business owners to support their employees’ retirement savings. Consider your company’s size, resources, and employee needs before choosing a plan. If administrative simplicity is your top priority, the SIMPLE IRA is a clear winner. If flexibility and employee options are more important, the SIMPLE 401(k) might be the better fit.

For more details on each plan type, consult with a financial advisor to ensure your choice aligns with your company’s goals and the needs of your workforce.

References:

https://www.irs.gov/retirement-plans/choosing-a-retirement-plan-simple-401k-plan

https://www.experian.com/blogs/ask-experian/simple-ira-vs-simple-401k-plans/#:~:text=SIMPLE%20401(k)%20plans%20require,don't%20provide%20this%20flexibility.

https://www.investopedia.com/articles/retirement/04/060904.asp

Legal Disclaimer for MoneyGuru Blog/Website

The information provided on the MoneyGuru blog/website is for educational purposes only and should not be construed as financial, investment, or legal advice. While every effort is made to ensure the accuracy and reliability of the information presented, MoneyGuru and its contributors do not guarantee its completeness or timeliness. Users are encouraged to consult with a qualified financial advisor or legal professional to discuss their specific financial situation and to obtain advice tailored to their individual circumstances.

MoneyGuru is not responsible for any decisions made based on the information provided on this website. All financial products, investment strategies, and other content discussed are presented for informational purposes only, and no guarantees are made regarding the performance or suitability of any particular investment or strategy.

The views and opinions expressed on MoneyGuru are those of the authors and do not necessarily reflect the views of the website's owner or any affiliated institutions. MoneyGuru does not endorse or promote any particular investment, financial product, or institution unless explicitly stated.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance is not indicative of future results. Always do your own research and consider your financial goals and risk tolerance before making any financial decisions.

By using this website, you agree that MoneyGuru and its affiliates are not liable for any losses or damages incurred as a result of using the information provided. Users are solely responsible for their financial decisions and should seek independent advice when necessary.

If you have any questions or need further clarification, please contact MoneyGuru.